Our Research Partner

We've partnered with Trading Central to help our members form confident, timely and educated investment decisions. Their dynamic product suite is available to you through our platform and has been painstakingly perfected since 1999 to best support you in finding, validating and timing your trades.

Become a member today to gain instant access to Trading Central's award-winning research:

- Independent second opinion for a clear sense of direction

- Key target and stop levels to craft your trades

- Markets Never Sleep®: 24H global coverage

- 8,000 assets covered: FX, Equities, Commodities & Indices

Analyst Views

Our Analyst Views indicator is your go-to source for direction and key levels. We will always be there with a directional perspective on every chart based on our award-winning technical analysis methodology.

Key levels to craft your trade

Leave the analysis to the experts, and use the output of our analysis to craft your trades. Get an instant viewpoint on our preferred direction along with target levels. Discover our alternative scenario based on a pivot level where we would change our view and offer target levels in the opposite direction.

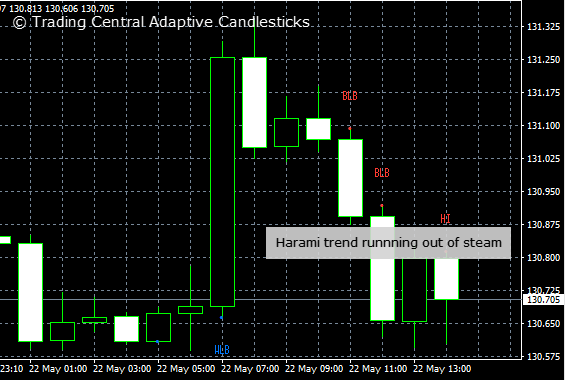

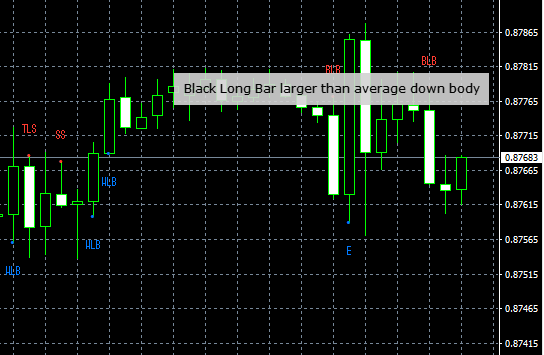

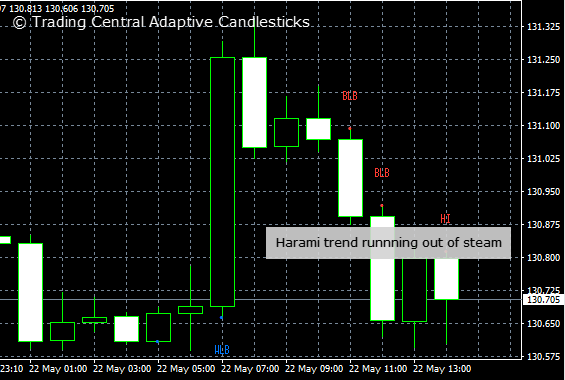

Adaptive Candlesticks

Traders love candlestick charts, and now get instant access to the candlestick patterns that illustrate important changes in supply and demand lines and the struggles between buyers and sellers.

Our favourite patterns

This indicator scans for sixteen of our favourite time-trusted candlestick patterns, instantly on any chart!

Expert filtering for what's important

We combine candlesticks with our unique quantitative and technical analysis expertise to focus in on only those patterns that are relevant for decision making based on current context.

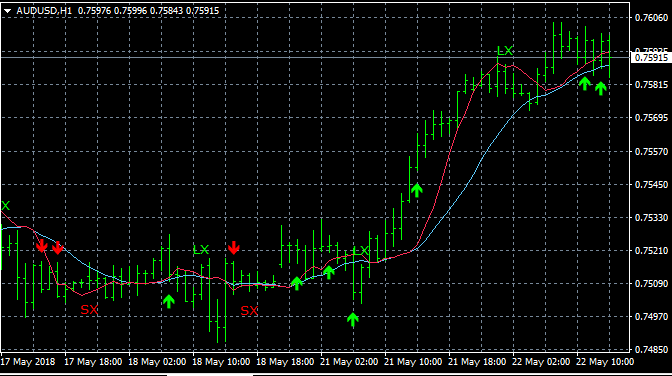

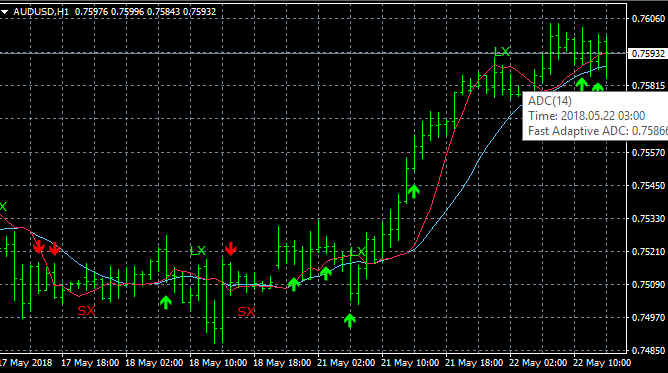

Adaptive Divergence Convergence(ADC)

If you like MACD, you'll love ADC for your short-term trading! It's useful at shorter lengths than MACD and offers more timely signals, while also guarding against sideways movements by adapting and lengthening during such periods.

Long & Short entry/exit signals

Labels help you spot trading opportunities: ↑ (long), LX (long exit), ↓ (short), SX (short exit). Signals are based on the status of all ADC components including price lines, indicators and oscillators. While these components all derive from the same adaptive "window" of market data, they do have some independence from each other so we can make decisions based on weight of evidence.

Slow & Fast price indicators

We use a front-weighted moving average for the slow indicator. The fast indicator emulates variable length weighted moving average—shorter in trends, longer in sideways markets. These can be used as other moving averages to offer slow signals by confirming the trend: look for lines sloping up and fast line above slow line; or price crossing above these lines. These indicators are the basis for other ADC components.

Raw & Smooth signal lines

For fast signals, look for upward sloping lines and ADC raw above ADC smooth as your buying signal. For slow signals, look for both ADC raw and smooth to be above 0. Like the MACD, the raw signal line plots the difference between slow and fast indicators (divided by slow) and this is smoothed with exponential averaging, but in this case we find the smoothing length automatically, typically around 4 unlike MACD's 9.

Oscillators Slow & Fast

ADC has two compatible oscillators. For fast signals, look for the fast oscillator to be sloping up and above zero. For slow signals, look for the fast oscillator to be above the slow; or look for the slow oscillator to be sloping up, below the fast oscillator, and above the adaptive filter.

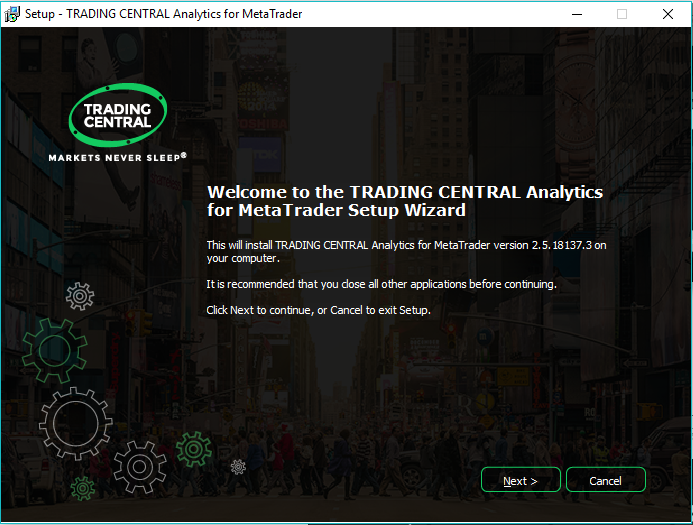

Download & Install

Sign up today and go through the easy installation process to get the plugin up and running immediately.